Exercise Your Financial Muscles to Get Financially Fit

“Those who work their land will have abundant food, but those who chase fantasies have no sense.” This ancient advice from Proverbs illustrates the importance of financial fitness.

What is financial fitness? Well, we are all familiar with the term physical fitness. If pressed for a definition, we might define it in terms of our own ideas and circumstances.

When it comes to an explanation of financial fitness, the same applies. A lot may simply depend on the season you are in. Financial fitness might mean something different to someone who is single versus a couple with young kids, an empty-nester or a retiree.

Even within those demographics, one’s perception could be colored by personal circumstances. Are you saddled with debt, debt-free, renting or a homeowner?

There are many ways to get ahold of your finances; you can increase earnings, lower spending, start saving more (short-term and longer-term) and implement debt management. For many, earnings are difficult to influence in the short-term. For most, tackling the spending side of the equation will yield the quickest results. Below we consider six principles that will help you get into financially fit shape wherever you find yourself in life.

6 principles for financial fitness

“An investment in knowledge pays the best interest.”—Benjamin Franklin

- Set goals. If you don’t have concrete financial goals, both shorter term and longer term, reaching some kind of level of financial fitness becomes much more problematic. Simply put, you don’t have a destination. You are financially adrift. As George Harrison has noted, “If you don’t know where you’re going, any road will take you there.” Short-term goals you might consider: Establishing three to six months of cash in an emergency fund, saving for a down payment on a home or auto, or saving for a vacation. Long-term goals: college savings for your kids and saving for retirement—at least 10% plus a company match.

- Do you know what ‘buckets’ your income lands in? How do you spend your income? If you aren’t tracking expenditures, you won’t have a holistic picture. You might be surprised at how much you spend on eating out, on entertainment, and even on a daily habit of barista-prepared lattes. Unnecessary spending can be diverted into savings or paying off debt, especially high-rate credit cards. Make timely payments. This will not only prevent you from accruing needless fees, but it will raise your credit score.Once credit cards are paid off, channel the excess funds into savings. When you accomplish shorter-term goals, reward yourself. It need not be extravagant, but accomplishments should be celebrated.Finally, you will struggle to follow a plan that is too draconian. Trim frivolous spending but leave some room for fun and hobbies.

- Your lifestyle shouldn’t exceed your income. If it does, you are burning through savings or taking on debt, and your stress level will reflect it. Excessive spending is not a path that leads to financial fitness. You want financial space in your life. You want ‘money at the end of the month,’ not ‘month at the end of your money.’ A budget is your blueprint that helps achieve this goal.Don’t let this be you: “Give me chastity and continence, but not yet.”—Augustine of Hippo

- Invest wisely. Among various factors, your financial goals, both shorter and longer term, will greatly influence the proper mix of investments. A diversified portfolio that crosses the spectrum can reduce risk and enhance your return over the long run. “Don’t look for the needle in the haystack. Just buy the haystack!” advises John Bogle, founder of Vanguard. In other words, diversify!We are here to assist you with that. Our recommendations are tailored to your financial goals and your unique circumstances. We avoid get-rich-quick schemes, which are usually nothing more than schemes minus the riches. Accumulation of wealth over a longer period is our goal. We believe it should be yours, too.“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” says Paul Samuelson, the first American to win the Nobel prize in economics.

- Enjoy your retirement. Many enter retirement after accumulating wealth over decades. They have learned how to save. For some, suddenly relying on that savings rather than earning income from labor seems like a daunting leap, one they may be ill-prepared to make. It doesn’t have to be that way. While your tolerance for risk (losing money) may change, we might recommend that you build a portfolio that allows for a degree of growth. We may also counsel a withdrawal rate from your retirement accounts of, say 4%-5%. These are broad-based guidelines and will differ from person to person, but it’s an outline that arms you with knowledge and enhances your financial fitness. Here’s another lesson from Proverbs: “Take a lesson from the ants. Learn from their ways and become wise! Though they have no ruler to make them work, they labor hard all summer, gathering food for the winter.”

- Protect your assets. Do you have life insurance, health insurance, and personal liability insurance? Do you have a will and estate plan? Who are your beneficiaries? What happens if you become disabled? Do you have a trusted advisor to handle your affairs? If you own your home without a mortgage, do you have homeowners’ insurance? Surprise, not all do. If you rent, renters’ insurance is cheap. It’s a must-have item.

Absorbing the fundamentals—the foundation for success

Those who fail to put sound principles into practice are like those who build their homes on sand. The rains come and the winds blow, and financial misfortune overtakes them.

Wisdom encourages us to build our homes on a solid financial foundation. Though the rains come and the winds blow (and they will), the house and foundation are designed to withstand the financial storms.

Every situation is unique. You may have mastered the fundamentals, and only need to apply the principles we highlighted selectively, plugging small holes and shoring up your finances. Or a more aggressive approach might be in order. Focus on one theme at a time. Some may apply. Others may not.

Having said all that, we never want to give the impression that you are all alone on a financial lifeboat. We are always here to assist.

A cautious, upbeat start to 2023

There was no shortage of gloom as the new year began. The Federal Reserve was signaling higher interest rates, and its aggressive campaign, started last year, to rein in inflation has been threatening to throw the economy into a profit-killing recession.

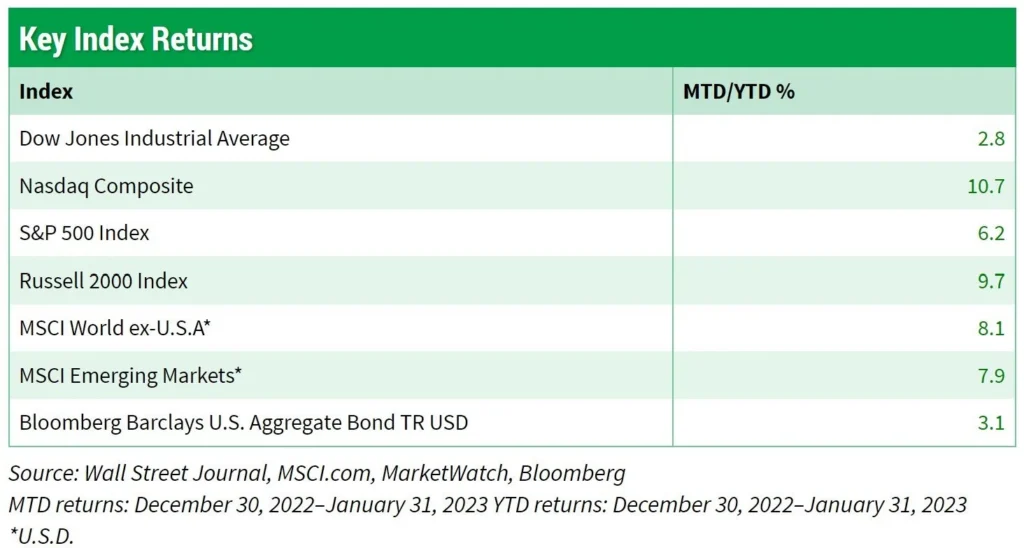

While investor sentiment is far from euphoric right now, 2023 is off to a strong start. What’s behind the move?

Last year, the Fed hiked its key lending rate, the fed funds rate, by 75 basis points (bp, 1 bp – 0.01%) in four consecutive moves.

Mix in a 50 bp increase in December and 25 bp increase back in March, and we experienced the most aggressive tightening cycle in over 40 years—1,000 bp in 6 months (St. Louis Federal Reserve) at the end of 1980. Ronald Reagan had not yet been inaugurated.

While the Federal Reserve is not yet signaling a halt to rate hikes and commentary suggests it could hold rates at a high plateau this year (what analysts have been calling ‘higher for longer’), the pace of rate increases is set to slow from last year’s nearly unprecedented level.

But are investors front-running the Fed? Or are they too optimistic about rates? Fed officials pushed back aggressively last year on a 2022 pivot.

Today, investors believe we may see at least one rate cut by the end of the year. Previously, that had not been in the Fed’s game plan, but Fed Chief Powell seemed less wedded to pushing rates above 5% at the February 1 press conference.

While Powell isn’t declaring victory on inflation and he isn’t ready to hint at a turnaround, he was more open to the recent moderation in inflation. The initial reaction was positive.

Looking ahead, a significant rise in the jobless rate would probably force the Fed to cut rates, but a drop in corporate profits could negate any benefits from falling rates.

How the Fed responds will be heavily influenced by how the economic outlook unfolds.

An opaque crystal ball

From 1970 through 2021, the January return on the S&P 500 Index exceeded 5% 10 times (St. Louis Federal Reserve data). Excluding reinvested dividends, the S&P 500 finished the year higher nine times. The 90% ‘win ratio’ beats the average since 1970 of 74%.

During the 10 years when January advanced by 5% or more, the S&P 500 averaged a return of 21.5%. Its best annual return was 31.6% in 1975, which followed the difficult 1973-74 bear market. Its only loss was 6.2% in 2018.

There are those who attempt to glean insights from expected market returns based on where we are in a political cycle. Such exercises are interesting, but let’s stress that each economic cycle has its own peculiarities that may override these barometers.

We know that past performance is not a guarantee of future results. Ultimately, the economic fundamentals will play a big role as the year unfolds.

We trust you’ve found this review to be educational and helpful.

If you have any questions or would like to discuss any matters, please feel free to give us a call.

As always, we are honored and humbled that you have given us the opportunity to serve as your financial advisors.

Ready for Judgment-Free Collaboration?

Step Into the No-Guilt Zone® and start a simple conversation.